Step-Up in Basis: Definition, How It Works for Inherited Property

4.9 (387) · € 17.99 · Auf Lager

1031 And Estate Planning

Exploring the estate tax: Part 2 - Journal of Accountancy

Step-Up in Basis and Why It Matters in Estate Planning

Step Up in Basis – What You Need to Know

IRS confirms that completed gifts to grantor trusts are not eligible for Section 1014 step-up

The Step-Up in Basis for Real Estate Explained

Step-Up in Basis: Definition, How It Works for Inherited Property

State Taxes on Capital Gains Center on Budget and Policy Priorities

Step-Up in Basis: What It Is & How It Works

IRS Publication 551: A Comprehensive Guide to Basis of Assets - FasterCapital

Step-Up vs. Carryover Basis for Capital Gains: Implications for Estate Tax Repeal

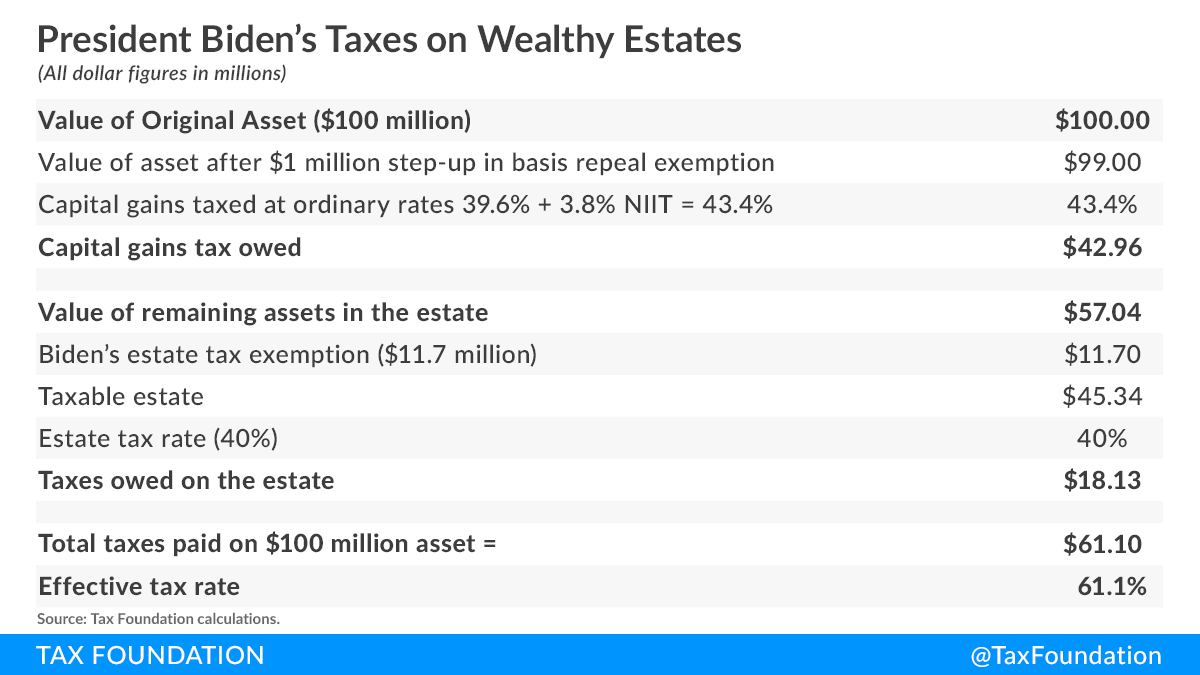

Biden Estate Tax? 61 Percent Tax on Wealth

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt

Understanding Federal Estate and Gift Taxes

Step-Up in Basis: Why It Matters in Estate Planning - Alexis Advisors

:max_bytes(150000):strip_icc()/paidupcapital.asp-final-46ec06676a584bc4b0eb1f2d9f65a73f.png)

:max_bytes(150000):strip_icc()/TermDefinitions_Stepupbasis-6fc33c446de546c7a4c63c41c4474cd2.jpg)